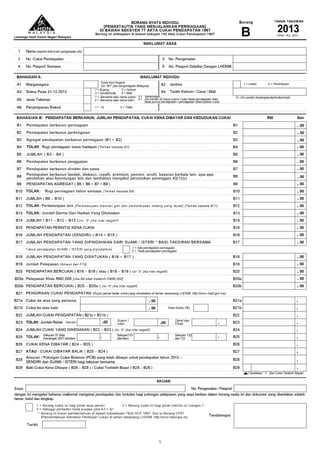

Form 24. Latest Borang B Proof of tax.

How To Step By Step Income Tax E Filing Guide Imoney

National Standards You must use the IRS National Standards to answer the questions in lines 6-7.

. Department of the TreasuryInternal Revenue Service. Apa beza Borang BE dan Borang B. For ease of filing you can use ezHasil to file your taxes online.

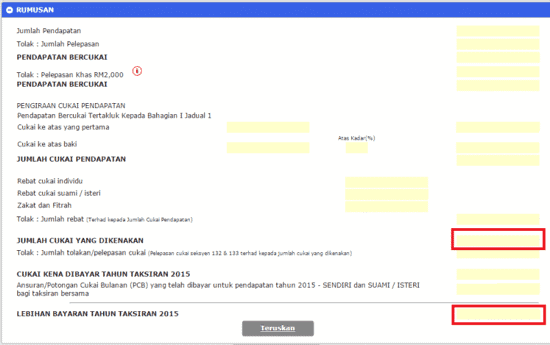

Based on this amount the income tax to pay the government is RM1640 at a rate of 8. Individual Income Tax Return. We have noticed an unusual activity from your IP 407716754 and blocked access to this website.

For Existing Standard Chartered Credit Cardholders. 21 65 years old. Kelulusan ejen cukai Tax agents approval no.

What tax exemption or deductions are foreigners entitled to. SECTION 89 OF THE INCOME TAX ACT 1967 SECTION 37 OF THE PETROLEUM INCOME TAX ACT 1967 This form is prescribed under section 152 of the Income Tax Act 1967 section 82 of the Petroleum Income Tax Act 1967 BAHAGIAN A. The more you reduce your chargeable income through tax reliefs and such the lesser your final tax amount will be.

Valid Business Renewal License. Latest Borang B Proof of Tax Payment. No documents are required.

Fill in the number of people who could be claimed as exemptions on your federal income tax return plus the number of any additional dependents whom you support. 18 65 years old. Borang BE untuk individu yang hanya ada pendapatan penggajian SAHAJA.

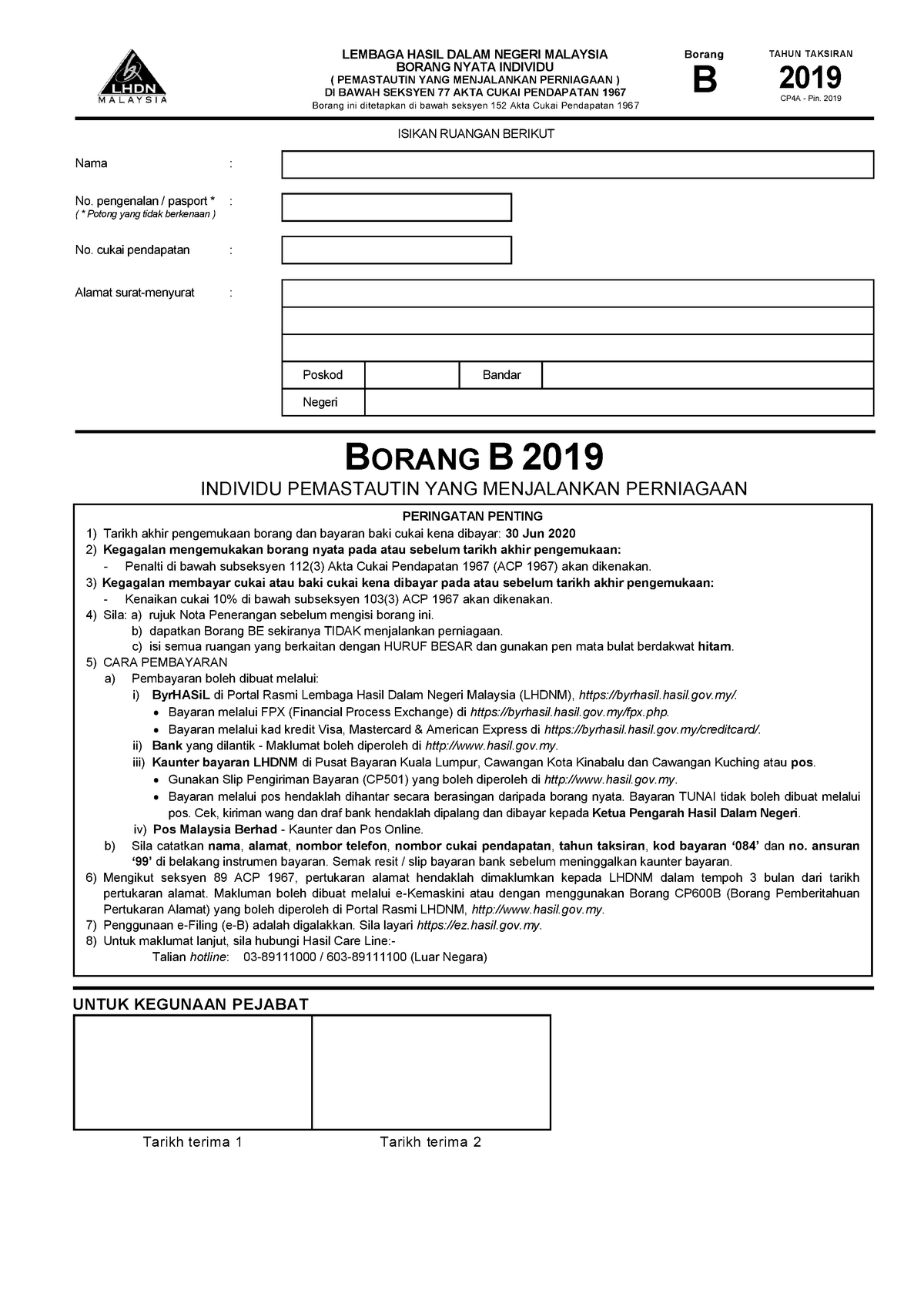

Check only one box. Manakala Borang B untuk individu yang mempunyai pendapatan perniagaan tak kira. Borang B 2019.

Please confirm that you are not a robot. Borang ini ditetapkan di bawah seksyen 152 Akta Cukai Pendapatan1967 seksyen 82 Akta Petroleum Cukai Pendapatan 1967. Borang BEB 2021 akan dimuat naik pada bulan Mac 2022.

Principal Card Minimum Annual Income. How to file your income tax. For example lets say your annual taxable income is RM48000.

This number may be different from the number of people in your household. PART H. Food clothing and other items.

IRS Use OnlyDo not write or staple in this space. B Kadar elaun tunai seperti cukai ditanggung oleh majikan elaun sara hidup atau elaun tetap yang lain dan kadar elaun berupa barangan seperti rumah kediaman pakaian dsb Monthly rate of cash allowances eg. It requests the name address and taxpayer identification information of a taxpayer in the form of a Social Security Number or Employer Identification.

Form 9 Form 13 if change of company name Business Registration Form. Cukai pendapatan Income tax no. However if you claimed RM13500 in tax deductions and tax reliefs your.

Telefon Telephone no. MAKLUMAT EJEN CUKAI PARTICULARS OF TAX AGENT H1 Nama Name H2 Alamat firma Address of firm Poskod Postcode Bandar Town Negeri State H3 No. Tax borne by the employer cost of living allowance or other fixed allowances and rate of allowances-in-kind eg.

3 BAHAGIAN H. Married filing separately MFS Head of household HOH Qualifying widower QW If you checked the MFS box enter the name of your spouse. Form W-9 officially the Request for Taxpayer Identification Number and Certification is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service IRS.

Non-residents filing for income tax can do so using the same method as residents. However you will be required to use the Form MMT Borang MMT instead of the Form BBE. July 2021 Amended US.

Anda nak tengok Borang BEB 2021. H5 e-Mel e-Mail AKUAN PEMOHON WAKIL SAH PENTADBIR. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

Individual Income Tax Return 2021 Department of the TreasuryInternal Revenue Service 99 OMB No. Single Married filing jointly. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

Use this revision to amend 2019 or later tax returns. However if there has been a recent. Latest 6 months business bank statement.

Latest income tax notice of assessment or latest 6 months CPF Contribution history statement.

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Borang B 2019 1 Tax Borang B 2019 Individu Pemastautin Yang Menjalankan Perniagaan Tarikh Terima Studocu

How To File For Income Tax Online Auto Calculate For You

Cara Isi Borang E Filing Cukai Pendapatan Individu Borang Be B 2021

Borang Be Cukai Pendapatan Your Tax We Care

Cara Isi Borang E Filing Cukai Pendapatan Individu Borang Be B 2021

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

My First Time With Income Tax E Filing For Lhdn Namran Hussin

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Trainees2013 Borang B Tax Otosection

Tarikh Akhir E Filing 2021 Bila Mula Isi 2022 Buka Tutup